MADA has once again demonstrated its vital role in protecting the interests of franchised auto dealers. Since the state legislature convened in January, MADA has maintained a steadfast presence at the state capitol working on legislation that could negatively impact dealerships across the state.

Legislative Review and Advocacy

With over 2,500 bills introduced, MADA carefully reviewed each one, identifying 52 bills that warranted attention. Among these, two pieces of legislation — HB 1538 and HB 1574 — emerged as top priorities on MADA’s “kill list” due to their potential harm to dealerships.

- HB 1538 aimed to prohibit non-U.S. citizens from receiving vehicle titles. This measure would have prevented dealerships from selling vehicles to individuals with temporary work visas, despite holding valid Mississippi driver’s licenses.

- HB 1574 sought to restrict motor vehicle dealers from sharing customer information with third-party vendors. Many dealerships rely on these vendors to deliver essential services, making this bill a significant concern.

Thanks to MADA’s proactive advocacy, both bills never made it out of committee, ensuring that dealerships can continue serving all eligible customers and utilizing trusted third-party partners.

Supporting Cybersecurity Liability Protection

In addition to defending against harmful legislation, MADA actively supports measures that benefit dealerships. The association is part of a coalition advocating for HB 1380 and SB 2471, which aim to protect Mississippi businesses from lawsuits resulting from cyberattacks. This legislation, spurred by last year’s widespread CDK cyberattack, offers liability protection to businesses that comply with federal cybersecurity guidelines. For dealerships using services like ComplyAuto, the bills would provide critical legal safeguards.

Continuing Education Requirement for Used Car Dealers Defeated

HB 1157, which would have mandated continuing education for used car dealers to maintain their licenses. The House strongly rejected this measure by a vote of 85-20, although the Independent Car Dealers Association supported the bill. MADA secured an exemption for franchised auto dealers licensed in Mississippi.

Tax Policy Takes Center Stage

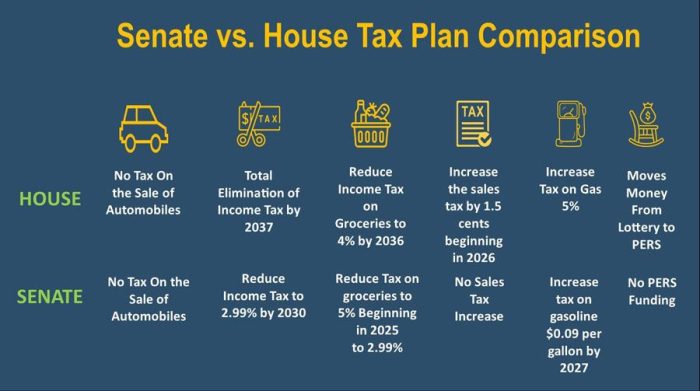

Tax reform has emerged as a key focus for both the House and Senate this session.

The first bill that the House passed this session was HB 1 — the “Build Up Mississippi Act.” This comprehensive bill aims to eliminate the personal income tax over 10 years. The plan reduces the tax on groceries but also increases the sales tax to 8.5%. To improve the funding for roads and bridges, the House proposes a 5% tax on gasoline.

The Senate plan reduces the personal income tax to 2.99% over four years. The tax on groceries will decrease from 7% to 5%, starting in July 2026. The gasoline tax will increase from 18.4 cents per gallon to 27.4 cents per gallon over the next three years.

Conclusion

MADA’s diligent advocacy and proactive engagement with state lawmakers continue to protect and advance the interests of Mississippi’s franchised auto dealers. By defeating harmful legislation, supporting cybersecurity protections and monitoring tax policy developments, MADA ensures that dealerships can thrive in an ever-changing regulatory landscape.